What is a Durable Power Of Attorney

What does Durable power of attorney do

WHAT IS DURABLE POWER OF ATTORNEY?

I

We’ve all had those moments. You’re watching a riveting legal drama, a significant character is incapacitated, and suddenly the term “Power of Attorney” crops up. Or perhaps, you’re in the middle of a casual conversation with a friend discussing the intricate webs of planning for future uncertainties, and the phrase “Durable Power of Attorney” is brought up.

As intriguing as these instances can be, they can also bring up pertinent questions. What is a Durable Power of Attorney? How can it be a key piece in your future planning puzzle? Fortunately, the Florida Planning & Probate law firm is here to provide you with a simplified yet comprehensive exploration of this essential legal tool.

BASICS OF A DURABLE POWER OF ATTORNEY

A Durable Power of Attorney (DPOA) is a crucial legal document that authorizes another person, referred to as an agent, to manage your personal, financial, and medical affairs should you become incapacitated or unable to make decisions on your own.

- A Durable Power of Attorney for finances, also referred to as a financial power of attorney, allows you to appoint an agent, often referred to as an attorney-in-fact, to manage your financial affairs. This includes handling transactions such as paying your bills, managing your investments, purchasing or selling real estate, filing your taxes, and other financial responsibilities.

- A Durable Power of Attorney for healthcare, also known as a healthcare proxy or medical power of attorney, allows you to appoint an agent to make healthcare decisions on your behalf should you become unable to do so. This may happen due to serious illness, accident, or advanced age.

DPOA is ‘durable’ because it remains valid even after you’re incapacitated, a crucial distinction from a general Power of Attorney which typically ends when the principal becomes mentally incapacitated.

BENEFITS OF A DURABLE POWER OF ATTORNEY

As your trusted estate planning attorney in Sunrise, FL, we cannot overstate the importance of a DPOA. The beauty of a DPOA lies in its foresight. It provides a contingency plan, eliminating the lengthy, expensive, and public process of appointing a guardian or conservator through the courts when you’re unable to make decisions for yourself.

Many adults, at some point, lack the capacity to make informed medical decisions. A DPOA ensures that someone you trust has the authority to make these decisions on your behalf.

Consultation Call Today: 954-557-7368

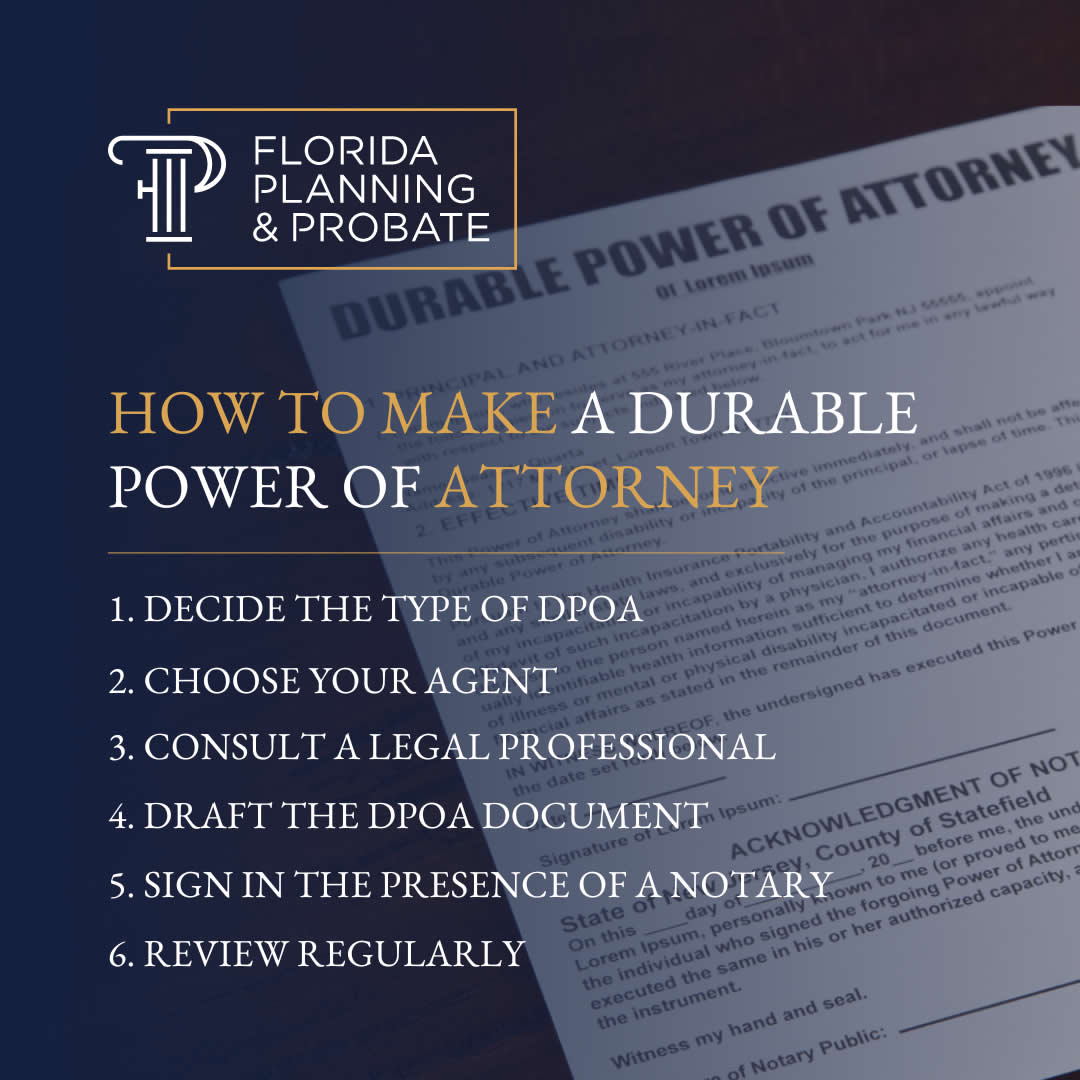

HOW TO MAKE A DURABLE POWER OF ATTORNEY

Creating a Durable Power of Attorney (DPOA) requires careful thought and a structured process. Here are the steps to follow:

1. DECIDE THE TYPE OF DPOA

Identify whether you need a DPOA for healthcare, finances, or both. Each serves a specific purpose, and your needs and circumstances will determine the most appropriate choice.

2. CHOOSE YOUR AGENT

Select a person you trust to act as your agent or attorney-in-fact. This person should be reliable, trustworthy, and capable of making decisions that align with your interests and wishes.

3. CONSULT A LEGAL PROFESSIONAL

It’s advisable to consult with a knowledgeable estate planning attorney, such as Geoffrey Langbart, our Florida estate planning attorney. They can guide you through the process, help you understand the legal jargon, and ensure that your DPOA complies with state laws.

4. DRAFT THE DPOA DOCUMENT

Your attorney will help draft the DPOA document, detailing the powers you’re granting your agent. Be as specific as possible to avoid any ambiguity.

5. SIGN IN THE PRESENCE OF A NOTARY

Once you’ve reviewed and agreed with the contents of the DPOA, you’ll need to sign it, typically in the presence of a notary public. Some states also require witness signatures.

7. REVIEW REGULARLY

Life circumstances change, and so do your needs. Regularly review your DPOA to ensure it still meets your requirements and reflects your current wishes.

Creating a DPOA is a vital aspect of estate planning, ensuring that your affairs are taken care of according to your wishes, even when you cannot make the decisions yourself. However, the process involves intricate legal procedures that are best navigated under the guidance of skilled attorneys like our South Florida estate planning attorney.

Contact us today to schedule your consultation with our experienced South Florida estate planning attorney. Secure your future, because you deserve nothing less.